In the ever-evolving landscape of telecommunication frauds, ‘Wangiri,’ a term of Japanese origin meaning “one ring and cut,” has emerged as a prevalent scam. More recently, an advanced version, dubbed ‘Wangiri 2.0,’ has also surfaced, employing more sophisticated tactics.

What is Wangiri Fraud?

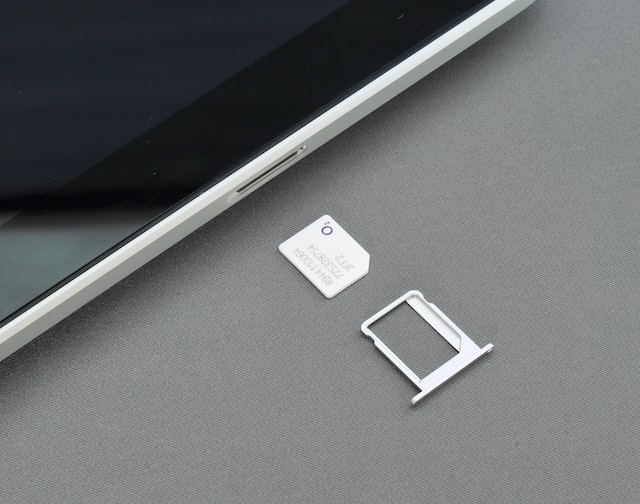

Wangiri fraud is a type of phone scam where the fraudster makes short, unsolicited calls to a large number of international numbers, including mobiles, landlines, and business numbers. The call hangs up after one ring, with the intention not to be answered but to entice the recipient to call back.

How it Works

- Missed Calls: Victims receive a missed call from an international number they don’t recognize.

- Call Backs: Curiosity or concern leads many to call back.

- Premium Rate Numbers: Unbeknownst to the victim, these numbers are often premium-rate numbers, charging exorbitant rates.

- High Charges: The fraudsters profit from the high call charges incurred when victims return the call.

The Emergence of Wangiri 2.0

Wangiri 2.0 is an evolved form of the original scam. It includes tactics such as:

- Spoofing Local Numbers: Scammers use technology to make their number appear local, increasing the likelihood of callbacks.

- Robocalls and Voice Messages: Incorporating automated messages that prompt longer call durations.

- Multiple Rings: Instead of one ring, Wangiri 2.0 might involve multiple rings to make the call seem more legitimate.

Why Fraudsters Benefit

- High Call Rates: The primary benefit for scammers is the profit made from the expensive rates charged for the callback.

- Anonymity: Using various technologies, fraudsters can mask their identity and location, making it hard to trace the call back to them.

- Volume of Calls: By automating the process, scammers can reach a vast number of potential victims, increasing their chances of success.

- Exploiting Human Nature: Curiosity and concern are powerful motivators. Many people return missed calls without suspecting they could be fraudulent.

Wangiri and its more sophisticated counterpart, Wangiri 2.0, represent a significant threat in the telecommunications fraud arena. These scams are successful due to their exploitation of human psychology, combined with the use of technology to mask the scammer’s identity and location. Awareness and caution are key in combating these types of fraud. It’s advisable never to return missed calls from unknown international numbers or numbers that appear suspicious. Being informed and vigilant is the best defense against these cunning schemes.

How can Honey Badger help?

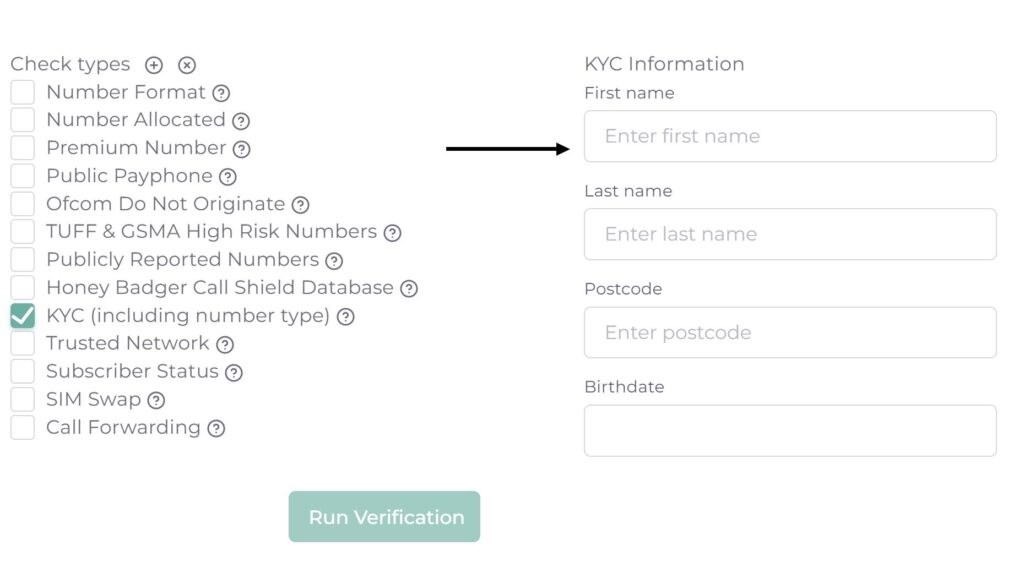

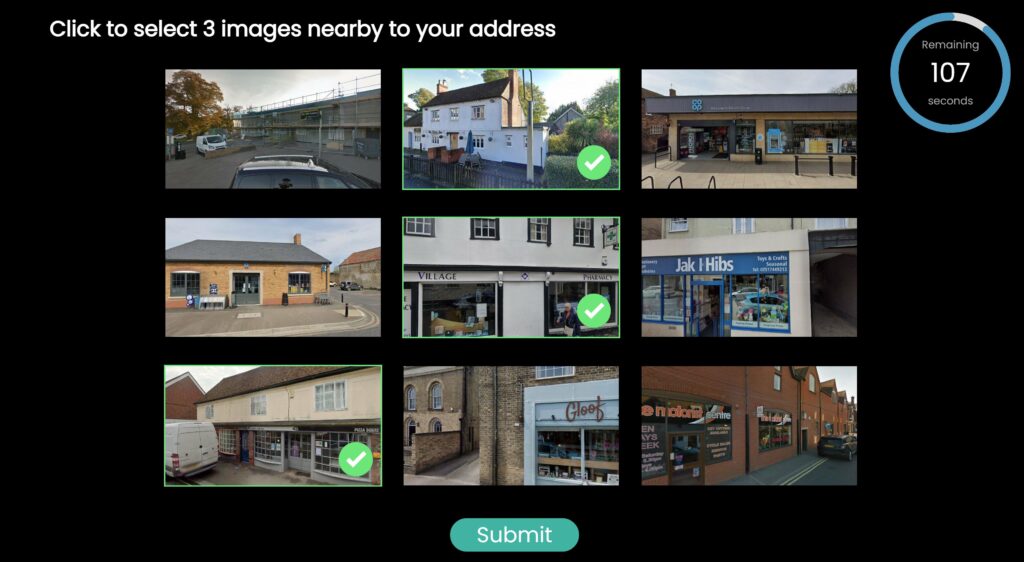

Honey Badger protects businesses from becoming victims of Wangiri fraud by providing real-time intelligence on phone numbers. Risk scores along with signalling data from the caller’s device instantly highlight risk and flag a number as being fraudulent. To find out more visit Honey Badger’s Risk Insights page.