Find out about the Risks of Invoice Financing

The world of business is filled with unexpected events and unfortunately, not all of them are positive. One situation that lenders face is when a reliable borrower unexpectedly behaves dishonestly. This becomes especially concerning in the world of invoice financing, as fraudulent invoices have the potential to result in substantial financial losses.

From Trustworthy to Treacherous

At the start of a lending partnership everything may go according to plan. The borrower appears low risk; a robust business strategy, punctual payments and precise invoices. Nevertheless, as time goes by and circumstances evolve, certain businesses might veer towards less ethical practices.

The submission of fraudulent invoices is one of those less ethical practices that’s on the mind of every business lender. But fraudulent invoices aren’t always a sign of a fundamentally corrupt business. More often than not, it’s a symptom of deeper financial distress or desperation.

Why Good Businesses Go Bad

In recent months businesses have faced unprecedented difficulties. They may be struggling with reduced sales, disruptions in their supply chains, higher interest rates and the unpredictable nature of the market. As a result, ensuring a consistent cash flow has become an incredibly challenging endeavour for many.

To maintain cash flow and stay afloat, certain businesses may be tempted to manipulate their invoices. Although this might provide temporary relief, the consequences can be severe and long lasting. It not only damages the trust established with lenders but also invites legal repercussions and tarnishes the company’s reputation.

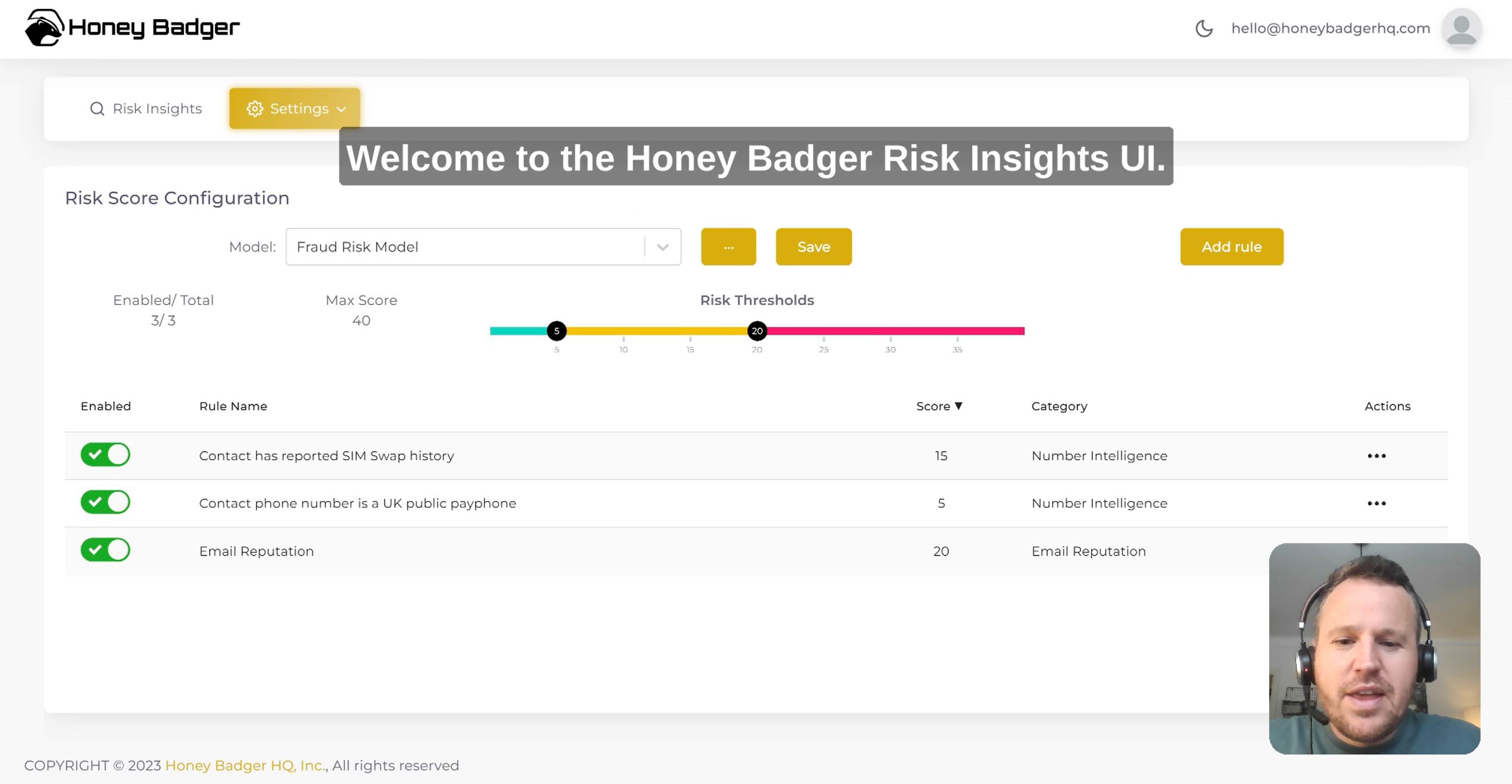

Watch how you can define your own credit and fraud risk checks in minutes.

The Pressures of the Current Economy

The global economic climate plays a pivotal role in determining how businesses operate. When times are tough, there’s an increased pressure to keep the cash flowing. This might lead to:

Overstating Invoices

Businesses may inflate the value of products or services rendered.

Duplicate Invoices

Some businesses may submit the same invoice to multiple financiers or submit it multiple times.

Phantom Invoices

In the worst cases, businesses might generate invoices for goods or services that were never provided.

The Role of Risk Insights in Stopping Invoice Fraud

Given the current economic pressures, lenders must be more vigilant than ever. This is where Honey Badger’s Risk Insights come into play. By providing lenders with credit and fraud risk insights based on company accounts, email addresses, phone numbers and contact information, a risk score can be determined and red flags can be identified.

However, where lenders would typically do this once when onboarding new customers, recent data shows that it’s more important than ever to run risk checks on a regular basis. Why? Because as the name of this blog posts suggests, we’re seeing a rise in good borrowers that become bad.

The Importance of Continuous Risk Insights

Performing Risk Insight checks on a regular basis is a lot like taking your car for a regular service. It’s better to identify potential issues before you break down at the side of the road. In the same vein business can show signs of underlying problems that could indicate increased credit or fraud risk over time.

Key insights to consider include things like overdue company accounts and changes or resignations in directors. Furthermore, running Risk Insights against the companies being invoiced against will detect phantom invoices.

Conclusion

It’s distressing to witness a good borrower go down the path of deceit. However, by not limiting risk checks exclusively to onboarding, and instead adopting continuous Risk Insights, lenders can identify and mitigate risk before fraud occurs. To explore Risk Insights further check out our article on some less obvious insights, schedule a call with an expert, or request a demo using the form below

Get a demo of Risk Insights

Enter your email address and we’ll send over some times for a demo.

Honey Badger HQ