At Honey Badger, we love insights. Especially when those insights enable our customers to accurately identify and mitigate fraud and credit risk. But when there’s thousands of insights at your fingertips, you might wonder which are the most effective?

That’s why we’ve put together 7 of the best risk insights as reported by our customers. From fintechs onboarding to lenders credit risk scoring, we’ve compiled a cross section of less obvious insights that should be on your radar.

IP Address

Location and VPN detection

Analysing a user’s IP addresses is a great first step in measuring risk. Our customers reported bad actors often attacked from overseas, so assigning higher risk to users in non-typical locations was effective. More sophisticated bad actors leveraged VPNs to spoof their location so additional risk points were added when a VPN was detected.

Company

Number of appointments

If you’re working with businesses then using Honey Badger to check a company’s status, insolvency history and accounts are up to date is a great way to identify credit risk. But our customers also reported that assessing the number of appointments, both active and inactive, was a good indicator of risk. Why? Because companies acting fraudulently were observed to have higher appointment activity, including directors that had appointments or resignations at many different companies.

Web Presence

Search result domain match

If you’re manually investigating a company you might find yourself starting with a web search. So, when it comes to automating risk scoring why not do the same? That’s exactly what our customers are doing, with one key insight being a check on whether top search results point to pages on the company’s web domain. That’s because spoofing or masquerading companies often had newer domains with less SEO.

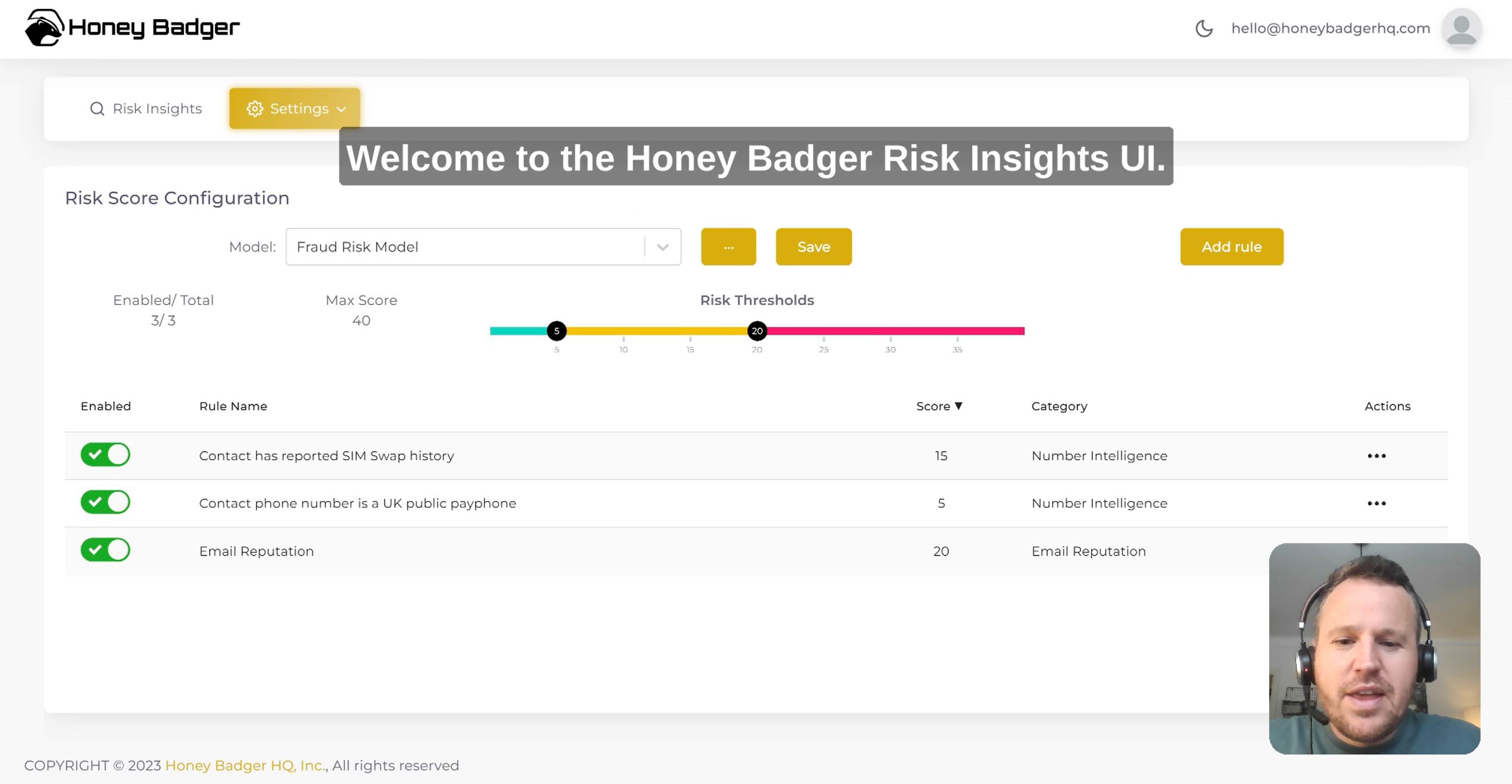

Watch how to define risk scores and create your own risk model with Honey Badger Risk Insights UI.

Phone Number

Mobile network and billing Plan

When it comes to risk, it turns out a user’s choice of mobile network and line type can say a lot about them. Some Honey Badger customers use this information to predict credit risk with the same accuracy as Open Banking analysis, while others found users with pay-as-you go phones on virtual mobile networks were more likely to be fraudulent. Ultimately, users on top tier networks with pay monthly contracts had undergone more checks and posed less risks.

Phone Number

Mobile network KYC verification

Mobile network and billing plan wasn’t the only phone number insight useful for measuring risk. Performing a 2+2 verification against the data held on file by mobile network operators was a reported as a top indicator of both fraud and credit risk. There was significantly less risk when the user’s first name, last name, postcode, and date of birth was successfully verified with the mobile network.

Deliverability

While email age and reputation are the most common risk insight delivered from an email address, are you also considering deliverability? This checks that the email address provided can receive emails. Our customers saw that bad actors more frequently have an incorrectly configured email domain, and sometimes used email addresses that looked official but couldn’t receive emails.

Online profiles linked to email

It’s probably no surprise that typically people use their email address for multiple different accounts and services they sign up to. That’s why looking at the number of online profiles associated with an email is a good indicator of risk. Our customers observed that email addresses linked with multiple online accounts, such as LinkedIn, posed less risk than those which didn’t have any associations.

In summary, there are thousands of insights that can be used to measure risk, but some are less obvious than others. To get creative with your own Risk Insights schedule a call with an expert and discover the data points you might be missing out on.

For more insights and thought provoking content be sure to subscribe to the Badger Blog.

Get a demo of Risk Insights

Enter your email address and we’ll send over some times for a demo.

Honey Badger HQ